50-Year Mortgages: What Hawai‘i Buyers & Investors Need to Know

Emil Knysh | Dec 2025

A practical and balanced breakdown for first-time buyers, second-home owners, and investors.

As affordability continues to challenge homebuyers nationwide – and especially in Hawai‘i – the idea of a 50-year mortgage has re-emerged in policy discussions and media outlets.

Supporters believe it can reduce monthly payments enough to help more people qualify. Critics warn it may increase total interest to levels that erode long-term wealth.

Below is a clear outlook tailored for Hawai‘i’s unique real estate landscape, with insights for both first-time buyers and real estate investors.

What Is a 50-Year Mortgage?

A 50-year mortgage is simply a traditional fixed-rate loan stretched from 30 years to

50 years (600 months).

- Goal: Make monthly payments more affordable

- Tradeoff: Dramatically higher total interest and much slower equity growth

For a national overview:

Reuters – “Would a 50-year mortgage make homeownership easier or riskier?”

For a consumer-friendly explanation:

SoFi – “Payoff in 2075? The Pros and Cons of a 50-Year Mortgage”

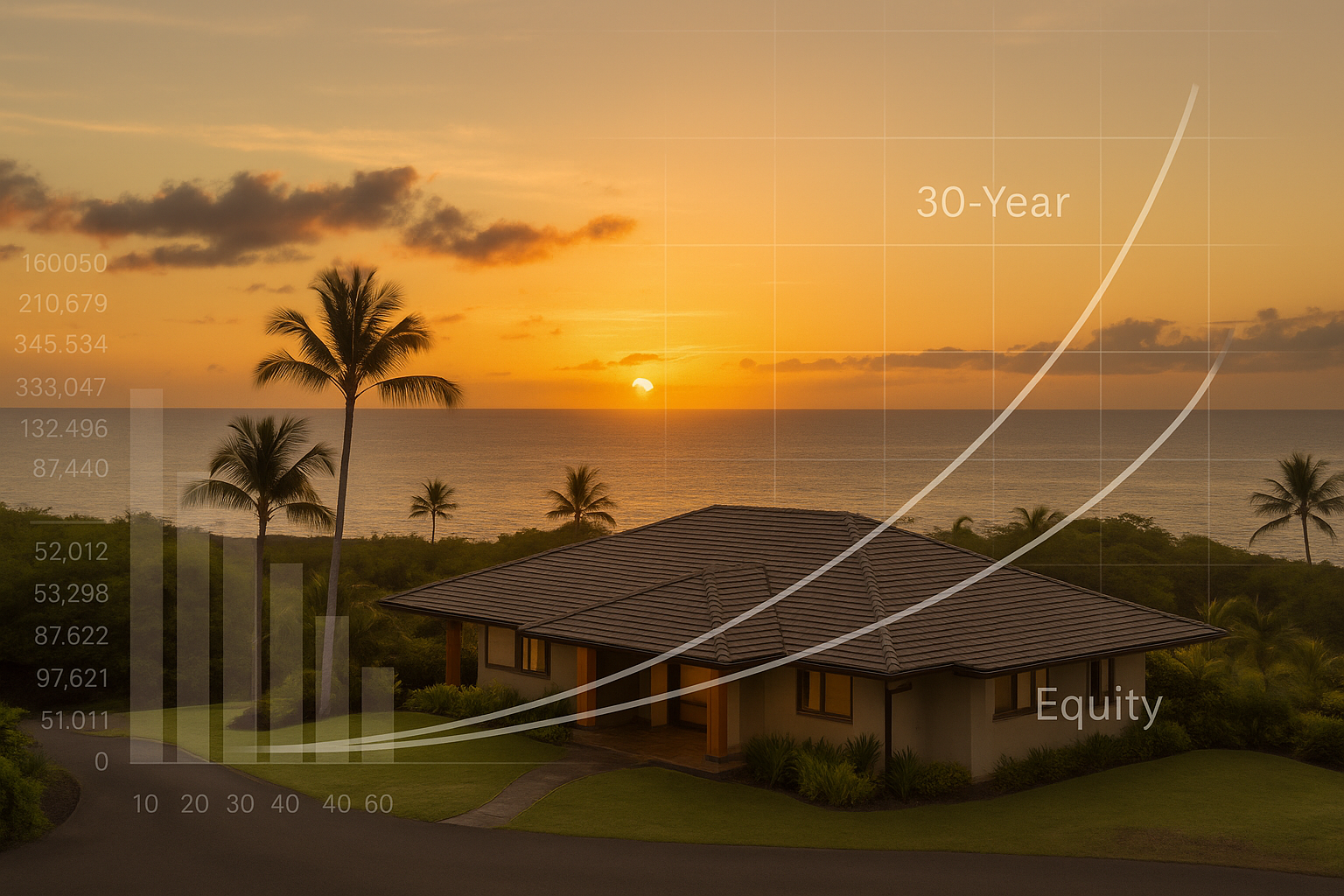

Chart 1: Loan balance over time – a 50-year loan takes far longer to pay down.

First-Time Buyers: What to Expect

Potential Upsides

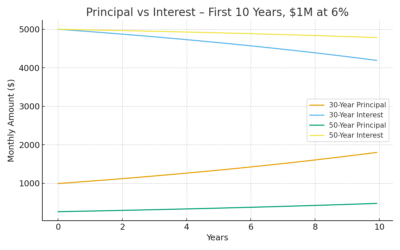

- Lower monthly payments. A 50-year loan reduces the monthly principal portion, making the payment more manageable and improving DTI ratios.

- More flexibility in entering high-cost markets. In areas such as Kailua-Kona, Holualoa, and resort zones, even incremental payment relief may help buyers secure primary homes sooner.

Important Downsides

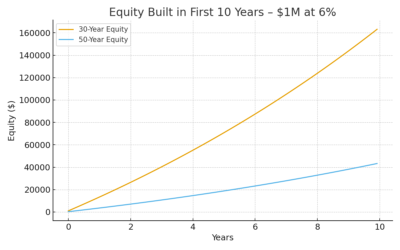

- Extremely slow equity growth. In the early years, most of the monthly payment goes toward interest, not principal, which limits how much equity is built if you plan to move or upgrade.

- Much higher lifetime cost. A 50-year loan often results in paying double or more the interest of a 30-year loan.

For a deeper breakdown, see

UBS – “What Would a 50-Year Fixed-Rate Mortgage Actually Mean?”

. - Mortgage may extend into retirement. Buyers in their 30s or 40s could still be making payments well into their 70s or 80s.

Investors & Second-Home Buyers: Pros & Cons

Potential Benefits

- Lower monthly debt service. Investors focused on cash flow or DSCR qualification may welcome a lighter monthly obligation.

- Improved liquidity and easier scaling. A slightly lower payment can increase portfolio flexibility, especially for investors managing multiple rentals or planning 1031 exchanges.

Key Risks for Investors

- Poor principal reduction. Investors relying on equity build-up for refinancing or repositioning may find the payoff curve far too slow.

- Total interest drag. A 50-year structure can add hundreds of thousands in added interest, eroding long-term returns.

A useful breakdown is:

Real Investment Advice – “50-Year Mortgages: Pros and Cons.”

- Refinancing risk. Refi opportunities may be limited if interest rates rise or property values stagnate.

- Exit strategy uncertainty. With principal reduction so slow, investors might not have enough equity to sell or exchange during softer cycles.

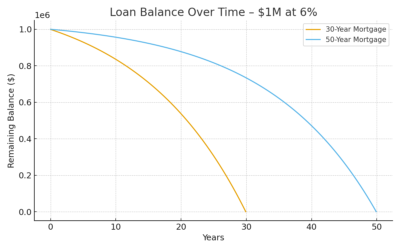

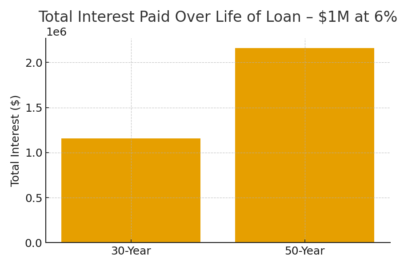

Key Numbers at a Glance

- 30-year payment: approximately $6,000 per month

- 50-year payment: approximately $5,300 per month

- 30-year total interest: roughly $1.16M

- 50-year total interest: roughly $2.15M

For broader national context on affordability:

Time – “What a 50-Year Mortgage Would Mean for Home Buyers.”

Why This Matters More in Hawai‘i

Hawai‘i’s real estate environment is defined by limited supply, high construction costs, and strong long-term demand.

This means a 50-year mortgage may help certain buyers enter the market, but it may not be ideal for short-term investors

or buyers needing fast equity growth.

Kai and I work with clients across West Hawai‘i and all major resort markets – from Kona to Hualālai, Kukio, Mauna Kea, Mauna Lani, and beyond – and we see firsthand how financing choices shape both short- and long-term outcomes.

For a strong industry perspective:

Inman – “8 reasons you should never recommend a 50-year mortgage.”

Final Takeaway: A Useful Tool, But Not a Universal Solution

The 50-year mortgage is neither a magic bullet nor an outright bad idea. It is a niche tool – potentially helpful for some buyers, risky for others.

May Be a Good Fit If You:

- Need lower monthly payments to enter the market

- Expect your income to grow over time

- Plan to hold the property long-term

- Focus primarily on lifestyle and access rather than fast equity growth

May Be Risky If You:

- Plan to sell or refinance within 5–10 years

- Need to build equity quickly

- Rely heavily on appreciation to make the numbers work

- Are nearing retirement and want to reduce long-term debt

Let’s Run the Numbers for Your Situation

Every buyer and every property is different. We can have our trusted loan specialist model repayment, equity growth, projected value, and long-term cost

for any home or investment property on the Big Island – from primary residences to short-term rental condos and resort homes.

Emil & Kai