Kona Single Family Home Market Trends

Kona’s single family market reflects the national story of tight supply and softening prices. The median price slipped 3.4% YoY to $1.255M, while closed sales fell 17.6%. Despite slower closings, pending sales hit their highest point in 2025, showing steady demand.

Inventory is at its lowest level in five months, keeping the market competitive. Homes are spending 27 days on market before going into escrow (up 29% YoY), while price per square foot remains steady at $731, highlighting resilient property values despite fewer transactions.

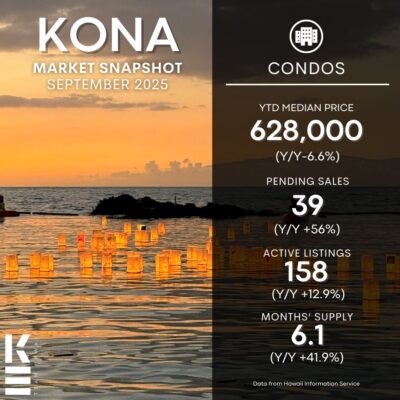

Kona Condominium Market Trends

Condos are seeing sharper price adjustments. The median price dropped 6.6% YoY to $628K, the largest decline since 2020. Sales are down nearly 10%, and price per square foot slipped 9.8% to $663.

Yet there are signs of stability. Pending sales have increased for two straight months, and inventory has settled back to December 2024 levels after peaking in March 2025. Still, days on market surged to 53 (up 157% YoY), suggesting buyers are more cautious.

Overall Kailua Kona Housing Market

Both single family homes and condos reflect the broader U.S. market:

-

Prices softening: -3.4% homes, -6.6% condos.

-

Sales slowing: -17.6% homes, -9.5% condos.

-

Inventory is restricted, acting as a counterbalance that prevents larger price drops.

-

Demand remains steady, with a rise in pending sales.

Nationally, inventory is 23% higher YoY, but fewer new listings and more withdrawn homes have leveled off supply. Sellers remain hesitant, echoing what we see in Kona.

Mortgage Rates and the Fed’s Upcoming Decision

The 30-year fixed mortgage rate averages 6.57%, the lowest in nearly a year. Rates have eased with cooling inflation and market expectations of a Fed rate cut on September 17.

If mortgage rates drop closer to 6.0%, affordability could improve, stimulating demand. However, a 25 bps cut may already be priced in, meaning the impact could be modest.

What Buyers and Sellers Should Know

-

For Buyers: With rates at their lowest in a year, this may be a window of opportunity. A further dip post-Fed could increase affordability.

-

For Sellers: With competition easing and fewer listings coming online, now is a strong time to attract buyers, especially heading into Kona’s active winter season.

Final Takeaway

Kailua Kona’s real estate market is balancing between restricted supply and softening prices. Much like the mainland, fewer sellers and cautious buyers are shaping conditions. The Fed’s September 17 decision could be pivotal. If rates approach 6.0%, momentum could strengthen across the Kona housing market.

For now, both buyers and sellers have opportunities to make strategic moves in a market that remains competitive yet balanced.