As we head into the final stretch of 2025, we’re seeing clearer signs that the Big Island’s real estate market – especially here in Kona and our resort communities – is beginning to find its rhythm again.

From single-family homes to resort condos, buyer interest is picking up just as national trends hint at easing interest rates. Here’s a closer look at what’s happening across the island – and beyond.

Kona Single-Family Homes: Steady and Holding

In November, pending sales rose to 55, up from 46 in October. That’s a modest but meaningful rebound in buyer activity, especially after a quieter mid-year.

-

Median price: $1.27M (+1.5% YoY)

-

Days on market: 30

-

Months of supply: 4.3

Inventory has thinned a bit from October, though still higher than this time last year. What does that mean? Buyers are back – but they’re moving more deliberately.

We’re no longer in the peak-frenzy era, but this market is far from idle. Demand in the upper tiers remains steady, and if this momentum carries into December, we could see prices hold firm into early 2026.

Kona Condos: Room to Breathe

The condo market showed welcome signs of life this past month.

-

Pending sales: 37 (up from 28 in October)

-

Median price: $620K (–4.6% YoY)

-

Inventory: 142 active listings

-

Days on market: 54

-

Months of supply: 5.6

While prices have softened slightly year-over-year, the increase in pending sales and tightening inventory suggests renewed buyer interest. This is still a neutral market – buyers have some room to negotiate – but we’re also seeing signs that the rebalancing from last year’s cooling may be behind us.

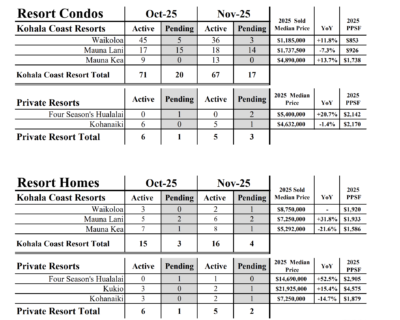

Big Island – Resort Condos: Tightening at the Top

-

Resort inventory peaked in July at 101 units

-

As of November, only 67 units remain

-

That’s fewer than we had at the start of the year

Among the resorts:

-

Mauna Lani is the most active, with a nearly 1:1 Active-to-Pending ratio. Strategic price adjustments seem to have drawn buyers back in.

-

Waikoloa Resort, by contrast, has seen less price movement and now sits at a 12:1 Active-to-Pending ratio, signaling softness.

The Private Club communities continue to outperform:

-

Hualalai is once again sold out

-

Kukio has just two active listings. $18M listing went into escrow this month.

-

Kohanaiki is rapidly expanding – already 50% built and launching new phases

-

The newest Alani units, priced around $5M, are selling before hitting the market

- $26M home went into escrow this month.

-

High-net-worth buyers remain drawn to exclusivity, lifestyle, and the long-term vision of these communities. And they’re willing to act decisively.

National Snapshot: What Compass Insights Are Telling Us

From Compass Chief Economist Mike Simonsen:

-

Interest rates dropped to their lowest point in over a year by late October

-

If that trend continues, we could see a boost in Q4 buyer activity

-

Stock markets remain near September highs, enhancing household wealth for many buyers

-

Median sale prices nationally (YoY):

-

Houses: +2.3%

-

Condos/Co-ops: –0.6%

-

-

Inventory is at its highest since 2019, though the growth rate is slowing

The housing market continues to show relative strength, while condos – nationally – have softened more noticeably.

What This Means Heading Into Year-End

On the Big Island, the story is one of balance returning. We’re not seeing explosive growth, but we’re also not seeing a crash. Instead, we’re in a more nuanced market – one where strategy, timing, and understanding your submarket matter more than ever.

If you’re a buyer, opportunities are emerging – especially in the condo and resort segments where selection is better and negotiation room exists.

If you’re a seller, the right pricing and presentation remain key, especially in a more selective market. But make no mistake – high-end demand is still there, especially for homes with a story and a lifestyle to match.

ACCESS FULL MARKET DATA: KE TEAM Market Flipbook Nov 2025

Considering a move or just curious about your property’s current value? Let’s talk. Whether you’re eyeing a winter purchase or planning ahead for 2026, we’re here to help you navigate with clarity and confidence.

– Kai & Emil