The Kailua Kona real estate market continues to experience notable shifts as we move into the summer season. June’s data shows diverging trends between single family homes and condominiums, with inventory levels climbing and demand softening across both sectors. Here’s a detailed look at what’s happening on the ground:

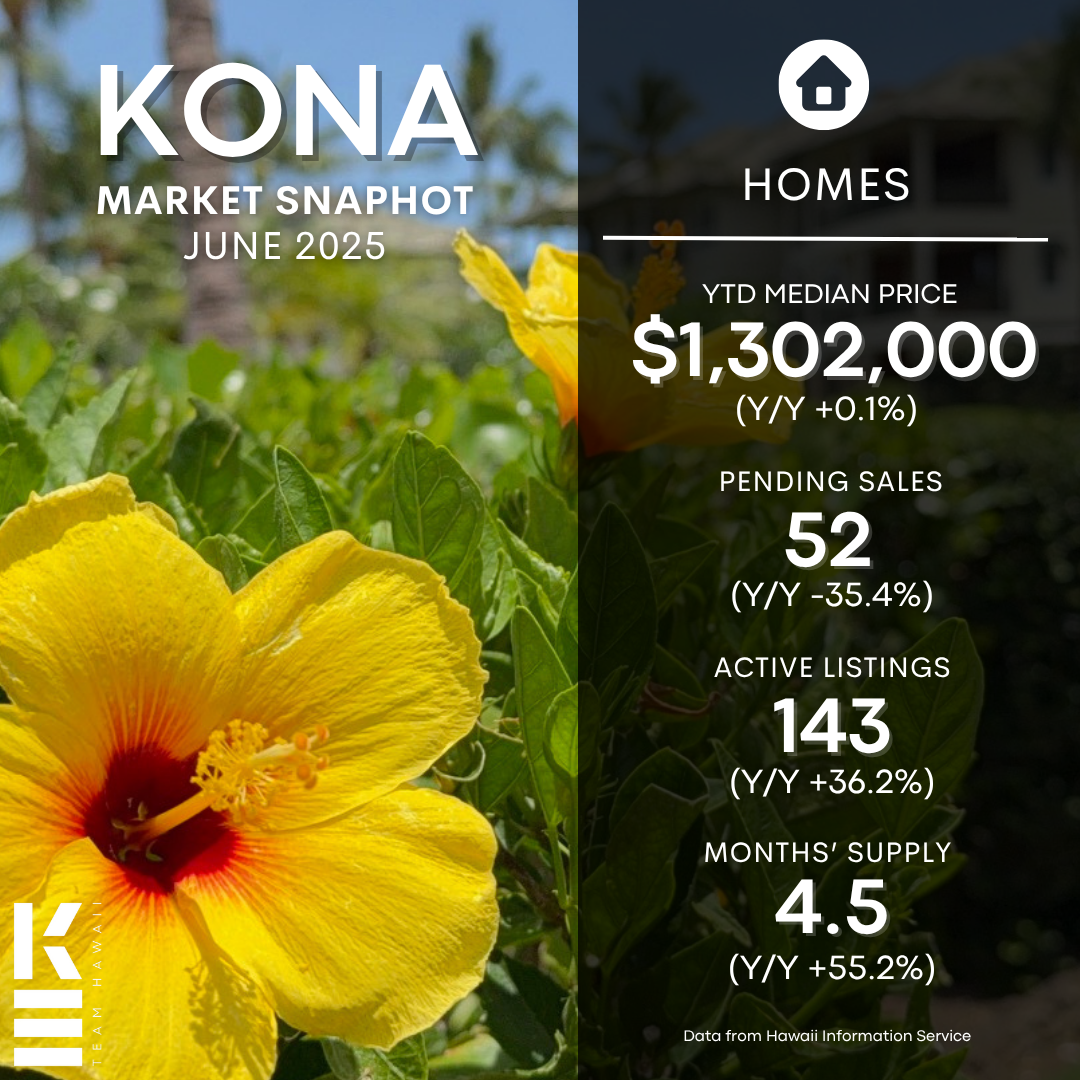

Single-Family Home Market Holds Steady, But Luxury Lags

The median price for single family homes has returned to its year-ago level at $1,302,000, reflecting a significant 6.5% month-over-month decline. While overall inventory has remained relatively stable from May, the number of Active Listings has increased 36% year-over-year. In contrast, buyer demand—measured by pending sales—is down 35% compared to the same time last year.

The market remains in neutral territory with a 4.5-month supply of homes. The median days on market has risen slightly to 23 days, signaling a slower pace. The most striking trend is in the luxury segment: only one pending sale is recorded above $2.5 million, marking the slowest activity in this price tier since 2020. This is a critical indicator to watch, especially as the summer season progresses.

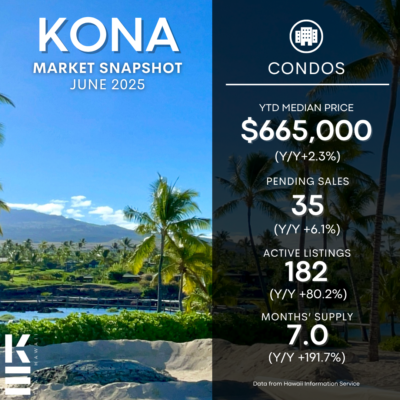

Buyers Regaining Control in the Condominium Market

Condominium prices remain 2.3% higher year-over-year, despite a month-over-month dip to a median of $665,000. The condo market is seeing a surge in inventory, now approaching pre-pandemic levels. Active listings have increased nearly 80% YoY, while pending sales are up slightly year-over-year but down compared to May.

With a 7.0-month supply, the condo market has clearly shifted into neutral to buyer territory. Homes are sitting longer, with the median days on market rising to 51 days, which is a 155% increase from last year. Price per square foot has declined by 8.2% YoY, providing more negotiation room for buyers.

Market Outlook: Summer may Bring Movement

Traditionally, Hawaii sees a seasonal uptick in real estate activity from June through August. The current environment—rising inventory, steady or declining prices, and moderating mortgage rates—could present opportunities for buyers looking to enter the market or upgrade.

The average 30-year fixed mortgage rate in June stands at 6.96%, a slight decrease from May’s 7.02%, offering some relief to potential buyers. One of my suggestions is for buyer clients to ask for a rate buy down instead of a price discount, which could save more money in the long run.

While sellers may need to adjust expectations and pricing strategies, especially in the luxury and condo segments, buyers have more leverage than they have in recent years.

What to Expect

June 2025 may be signaling a transitional period for Kailua Kona real estate. With rising supply and tempered demand, the market appears more balanced than in recent years. However, the sharp slowdown in high-end activity and increasing days on market signal the importance of close monitoring as we move into the second half of the year.

If you’re considering buying or selling in Kailua Kona, now is the time to strategize.