Overview of the Kailua Kona Market in 2025

The Kailua Kona real estate market experienced a notable transition in 2025. After several years of limited inventory and rapid absorption, market conditions shifted toward balance. Inventory levels increased, buyer demand softened on a year-over-year basis, and pricing adjusted in response to affordability constraints and changing buyer behavior.

This shift did not indicate market distress, but rather a move toward more sustainable conditions where pricing accuracy, absorption rates, and segmentation play a greater role than urgency.

Hawaii Kailua Kona Condo Market Update Jan 2025

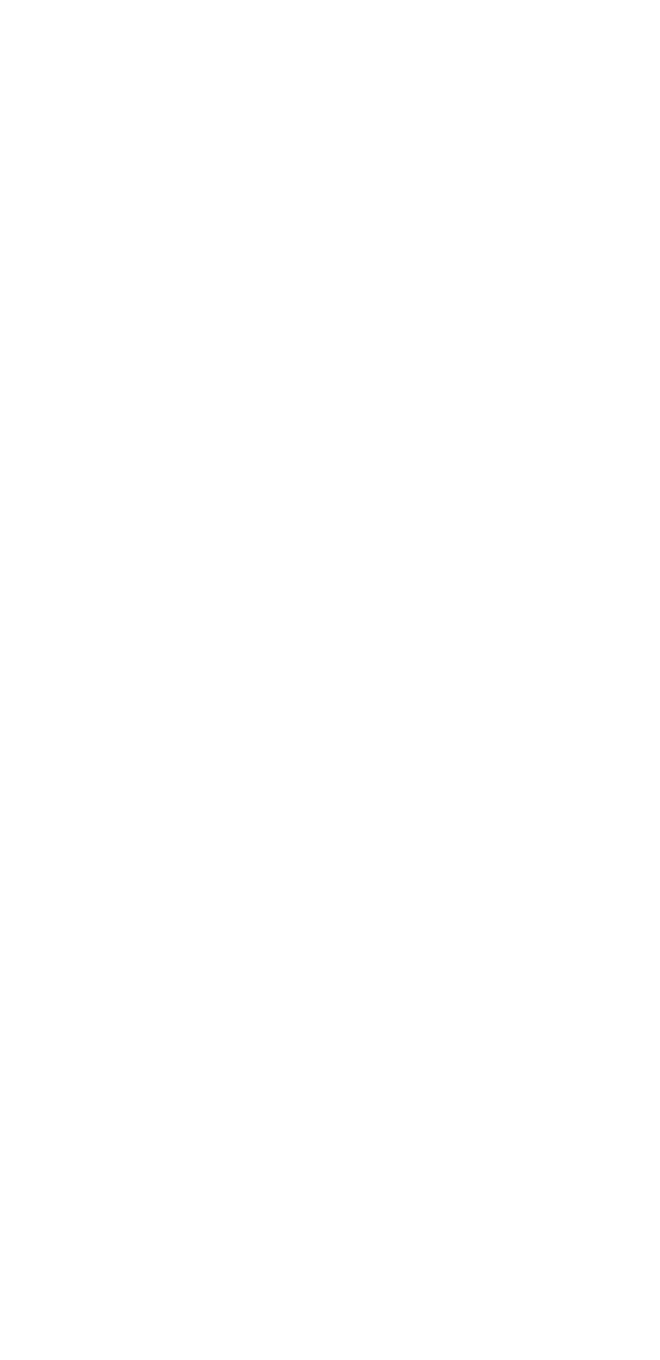

Kona Condominium Market Trends

Condominiums led the market adjustment in 2025. Active listings rose sharply as the year ended, including a significant December-to-January increase. At the same time, pending sales declined, slowing the pace of absorption.

Kona Condo Months Supply Jan 2026

Months of supply increased to 6.4 months, ending a declining trend that bottomed late in the year. Pricing reflected this change, with median price per square foot declining 9% and median days on market rising to 57 days. These indicators point to a more deliberate transaction environment with increased buyer selectivity.

As the condo insurance situation shows signs of stabilization and the market moves toward its historically stronger months, conditions may support increased condo market activity. Inventory often continues to rise through February, reflecting sellers’ positioning for the peak season.

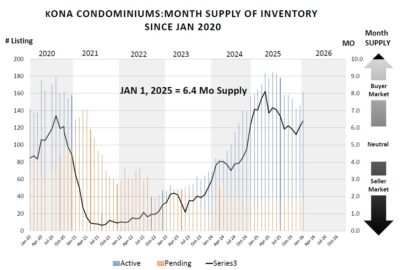

Kona Single Family Home Market Trends

Kailua Kona SFH market update Jan 2026

The single-family home market showed more moderate changes. Median prices declined 2.1% year-over-year, while inventory expanded meaningfully as 2026 approached. Active listings rose over 11% from December to January, representing one of the most significant month over month increases in recent years.

Pending sales remained relatively stable month-to-month but were lower than the prior year. This imbalance pushed months of supply to 5.7 months, the slowest absorption rate seen in FIVE years. Despite this, price per square foot declined only slightly, and median days on market remained efficient at approximately 30 days.

Just as with condos, the inventory tends to build up until February.

Kona SFH month supply Jan 2026

Frequently Asked Questions About Kona Real Estate

Is the Kona real estate market slowing?

The market is not stopping, but it is moving at a slower, more deliberate pace. Inventory increased in 2025 while demand softened year-over-year, resulting in longer selling timelines.

What happened to Kona condo prices in 2025?

Condo pricing adjusted. Median price per square foot declined 9%, and homes took longer to sell, reflecting slower absorption.

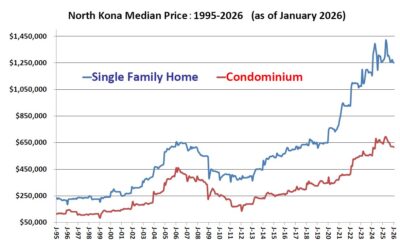

Kona Median Price 1995-2026

Is Kona a buyer’s or seller’s market?

By the end of 2025, market conditions were closer to balanced. Condos leaned more buyer-favorable, while single-family homes remained closer to neutral when priced correctly.

What does months of supply mean in Kona real estate?

Months of supply measures how quickly inventory is absorbed. Higher numbers in 2025 indicated slower sales and reduced urgency.

Which price ranges faced the most resistance?

Homes priced between $3M and $10M experienced the most resistance, while properties above $10M showed steadier demand.

Kona Hawaii SFH market activity by price range, Jan 2026

What is the outlook for Kona real estate moving into 2026?

The market is entering 2026 in a more stable and predictable phase, characterized by higher inventory, slower absorption, and pricing discipline. Hawaii market is seasonal. The market typically gets busy from January to July.