Hawaii’s TMK Numbers Explained — A Simple Guide for Big Island Property Owners

If you’ve ever looked at a Hawaii property listing or tax record, you’ve probably seen a string of numbers called a Tax Map Key (TMK). To many, it looks like a random code. In reality, it’s a precise and practical way Hawaii organizes every piece of real estate.

Much like an APN (Assessor’s Parcel Number) in California, Hawaii’s TMK is a unique identifier used to track property ownership, taxation, and location. For anyone buying, selling, or simply managing property in Hawaii, understanding TMKs is essential.

Today, let’s demystify the TMK system so you can confidently find your property, understand its official records, and navigate Hawaii real estate like a pro. Once you know how it works, you can tell the general location of the property just by looking at street address. Also especially on the Big Island, the zip codes do not work well when searching properties. It is so much easier to navigate real estate using TMK numbers.

What Is a TMK?

A TMK (Tax Map Key) is a multi-part numerical code assigned to every parcel of land in Hawaii. It’s used by state and county agencies to:

-

Identify property ownership.

-

Assess property taxes.

-

Locate properties on official maps.

-

Track legal descriptions and boundaries.

Think of it as a property’s “social security number”: unique, trackable, and essential for all official transactions.

Breaking Down the TMK Number

The Hawaii TMK is made up of six segments, each telling you something specific about the property:

-

Island (1 digit)

-

Oahu: 1

-

Maui (includes Molokai & Lanai): 2

-

Hawaii Island (Big Island): 3

-

Kauai: 4

-

-

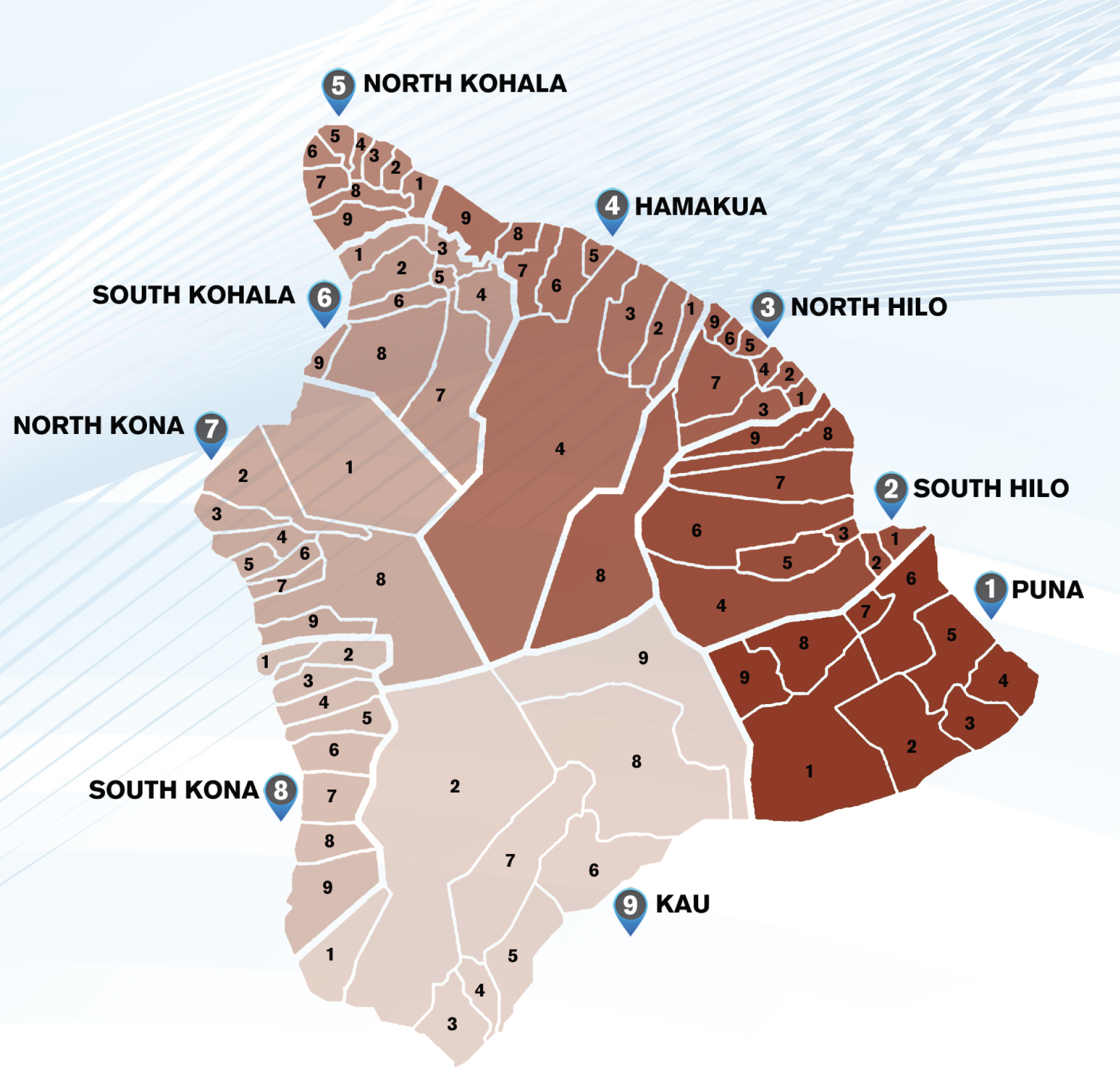

Zone (1 digit)

-

Divides each island into nine major districts.

-

Example: Zone 7 on Big Island is North Kona.

-

-

Section (1 digit)

-

Subdivides each zone into smaller sections (1–9), typically numbered clockwise.

-

-

Plat (3 digits)

-

Refers to a specific map grid within the section.

-

-

Parcel (3 digits)

-

Identifies the individual lot or piece of land.

-

-

CPR (Condominium Property Regime – up to 4 digits)

-

Used only for condo units to specify individual units within a building or complex.

-

Example:

A TMK like (3) 7-5-004-067-0001 tells you:

-

(3) Big Island

-

Zone 7 (North Kona)

-

Section 5

-

Plat 004

-

Parcel 067

-

CPR 0001 (Unit 1 in a condo)

TMK vs. Street Address — What’s the Difference?

While a street address helps with mail delivery and general directions, the TMK pinpoints a property’s exact location within the official land records.

In fact, in Hawaii, the first two digits of a street address correspond to the Zone and Section numbers of the TMK.

Why TMKs Matter to You

Whether you’re a homeowner, buyer, or seller, knowing your property’s TMK has real benefits:

Find Your Property Online

Use the TMK to search County Real Property Websites and access tax records, zoning info, and ownership details.

Ensure Accurate Transactions

TMKs appear on deeds, title reports, and surveys, helping to avoid costly mistakes in real estate deals.

Understand Government Oversight

TMKs are how Hawaii’s government assesses property taxes and regulates land use. It’s the foundation for managing real estate across the islands.

Simplify Property Searches

For real estate professionals and savvy buyers, TMKs make it easier to locate properties that fit specific criteria, especially when addresses are ambiguous.

Still have questions about TMKs or Hawaii real estate?

Contact us today or explore more resources at www.keteamhawaii.com.