National Real Estate — Kailua-Kona — Big Island Resorts — Private Clubs

As we wrap up 2025, we’re seeing something we haven’t seen in a while: a market that feels… somewhat balanced.

After three years of volatility, we now have more inventory, fewer bidding wars, and more realistic pricing in many regions. Demand picked up modestly in the second half of the year, and while every area is different, the overall pace feels healthier.

This post breaks down what’s happening nationally, what we’re seeing here in Kailua-Kona, and what may be ahead for 2026 across the Big Island, including our resort condo communities and ultra-luxury private clubs.

National Real Estate Market — December 2025

Across the U.S., we’re entering what may be the most stable environment since before the pandemic.

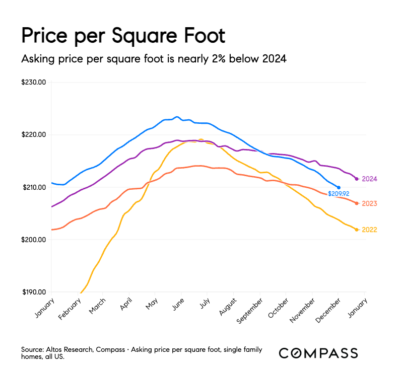

Supply is Normalizing

There are now 817,000 active single-family listings nationally, up 15.7% year over year. This is the first truly sustained inventory recovery we’ve seen since 2019.

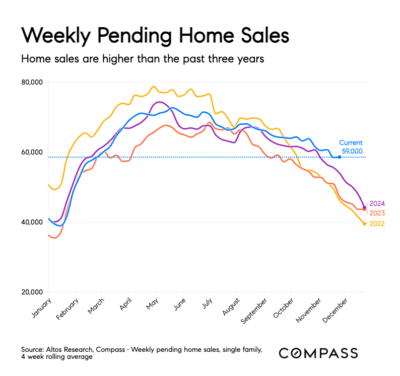

Demand – Buyer Activity is Improving

-

Weekly pending sales are running about 8% higher than last year

-

November saw the most buyers in any November since 2021

More options and less pressure have brought some buyers back into the market, especially those who hit pause in 2023 or early 2024.

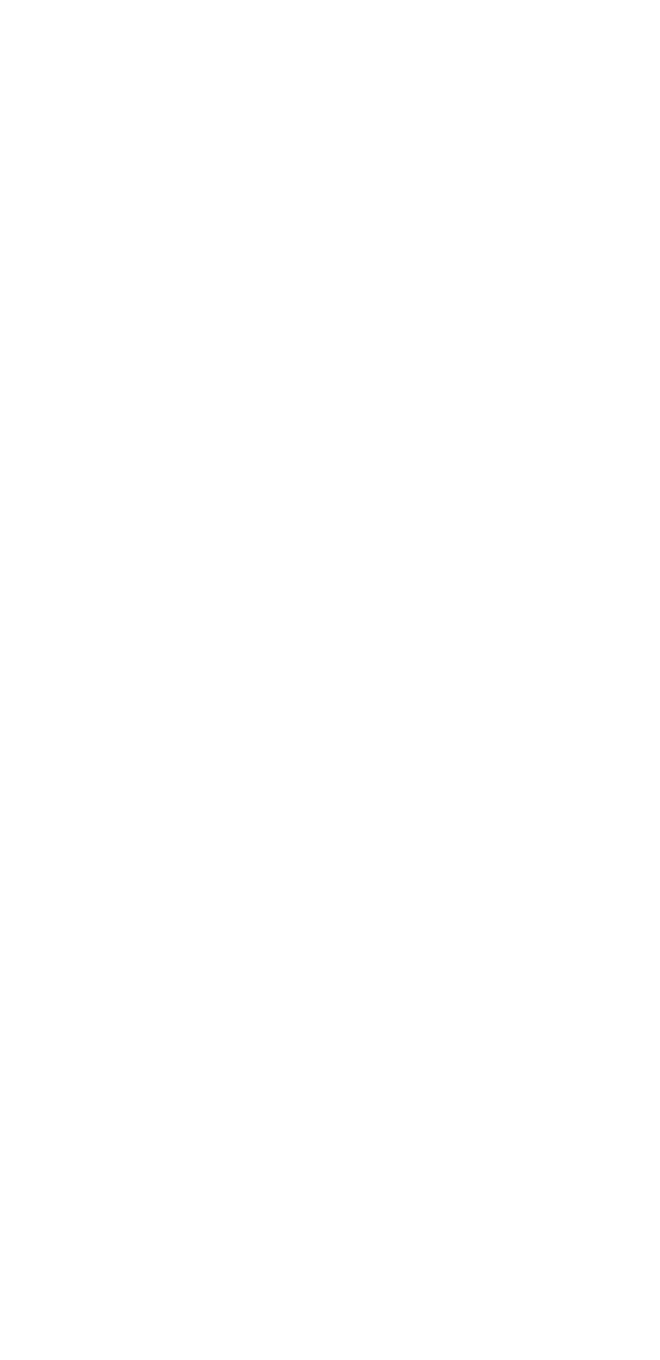

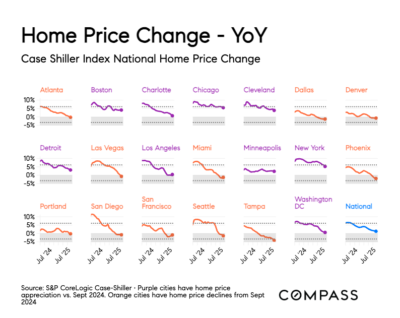

Prices Are Settling

-

Median price per square foot is just under $210, down nearly 2% from last year

-

Case-Shiller reports 11 of 20 major metros in negative territory

-

Tampa leads declines at -5%, while cities like New York and Chicago are still positive at +5%. Real estate is hyperlocal but we can definitely see the big trend.

Bottom line: More inventory has led to softer prices – and that same inventory has helped revive buyer interest.

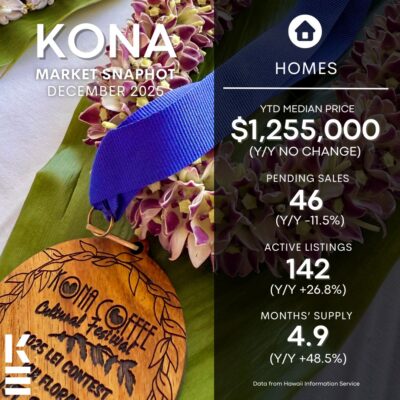

Kailua-Kona Real Estate — December 2025

The Kona market ends the year more balanced than in recent memory, but with important differences between condos and single-family homes.

Condos: A Quiet Comeback

2024 and much of 2025 were slow for condos in Kailua-Kona. Two big reasons:

-

Ongoing insurance uncertainty across Hawaii, which affected financing and association coverage

-

Affordability concerns, especially with rate fluctuations early in the year

But by late 2025, we saw a meaningful shift. Prices were adjusted in many buildings, and progress toward resolving Hawaii’s insurance crisis created more confidence.

December pending condo sales were the strongest in four years. Investors and second-home buyers returned to the market, drawn by improved pricing, limited supply, and early signs of stability.

Condo momentum is back, and we expect 2026 to start on firmer ground. The monthly supply improved from 8.1 months to 6.1 monhs in 2025.

Single-Family Homes: Measured and Price-Sensitive

Inventory has grown to 142 active homes, up from last year, but still well below pre-COVID levels. Many predicted a rapid increase in inventory, but the number actually decreased since the summer.

Spring 2025 was particularly slow, impacted by:

-

Broader economic concerns with Tariffs

-

Longer and more costly construction

-

Buyer hesitation amid fluctuating mortgage rates

Since then, the market has found its footing. Pricing expectations have adjusted, days on market are lengthening slightly, and the pace has normalized.

Trend: Homes are selling, but accurate pricing matters more than ever.

Big Island Resort Market — December 2025

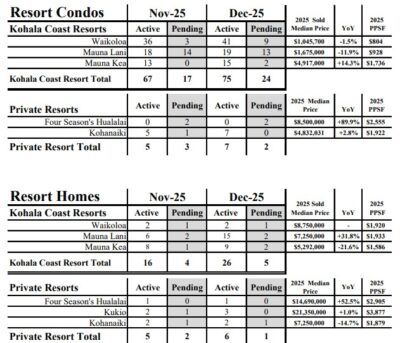

Resort Condos

Inventory peaked at 101 units mid-year, but dropped to 75 by December — even lower than where we started in January.

Buyer demand is up 85% from last year, as second-home buyers and investors respond to better price alignment and long-term confidence in Hawaii’s tourism outlook.

Mauna Lani Resort

-

Active-to-pending ratio: 1 to 1.5 — a strong sign of buyer engagement

-

-12% price adjustments in 2025 brought buyers back and restored balance

Waikoloa Beach Resort

-

Prices have eased slightly — median values down 1.5% year over year

-

The active-to-pending ratio has improved dramatically, from 1:12 to 1:5 in December, as median prices come down

Ultra Luxury Private Resort Market — Hualalai, Kukio and Kohanaiki

Ultra-luxury continues to follow its own rhythm, driven by lifestyle preferences and long-term wealth trends, not mortgage rates.

Hualalai (Four Seasons)

-

Median villa price: $8.5M – up 90% year over year. Quite amazing. Sold out, and the 2025 median DOM is zero.

-

Effectively sold out, with just one new listing available at $25M

Kukio

-

Only one active listing remains after two homes went into escrows in this month ($18M and $29M., one being represented by KE Team)

-

Median pricing remains well above $20M

Kohanaiki

-

Roughly 50% built, with active expansion

-

New Alani units (starting around $5M) are selling pre-market

-

A premier front-row home is currently in escrow for $26M

Scarcity continues to define the ultra-luxury space – and demand remains strong.

Looking Ahead: 2026 Forecast

We see potential for a stronger year, but it all depends on the bigger picture.

Three Key Factors Will Shape 2026

-

Inflation: Continued cooling is essential. A rebound would increase pressure on lending and consumer confidence.

-

Mortgage Rates: A meaningful and sustained break lower — not just short-term dips — is needed for widespread buyer recovery.

-

Employment: The labor market remains strong, but if that shifts, housing demand could follow quickly.

Why Regional Trends Matter

National data provides a helpful pulse, but many of the national stats lag real-time data we use to analyze the local Hawaii market.

Our market depends on feeder markets like California, the Pacific Northwest, and increasingly, parts of the Midwest and Northeast, all of which showed solid demand this year. Texas, another big feeder market, saw a market decline in 2025.

Keeping an eye on both the national picture and feeder market performance gives us the clearest view of what’s next for Kona, our resort corridor, and our private clubs.

Final Thoughts

2025 was a year of reset, and the result is a market that feels more grounded.

Condos are rebounding. Homes are finding their pace. Private clubs are as competitive and exclusive as ever.

2026 holds real promise, but it’s not guaranteed. Staying informed and making decisions based on your goals, not headlines, will make all the difference.

If you’d like to talk about how these trends impact your next move, reach out anytime.

For more detailed market information, please access our latest market update flipbook.

Kai and Emil