By Kai Ioh and KE TEAM Hawaii

Kai Ioh is a luxury real estate advisor based in Kona, Hawai‘i, specializing in resort and ultra-high-net-worth markets across the Big Island.

Key Takeaways

-

The Kohala Coast resort market is increasingly segmented by lifestyle, not price alone.

-

Established premier resorts are showing steadier demand than entry-level resort properties.

-

Private resort communities remain driven by scarcity and long-term lifestyle priorities.

-

Market momentum varies significantly by resort, making location and positioning critical today.

How the Kohala Coast Resort Market Is Differentiating

The Kohala Coast is no longer a uniform resort market. Buyer behavior is increasingly shaped by lifestyle preferences, amenity quality, and long-term use rather than short-term market cycles.

Over the past year, activity has concentrated at established resorts and private club communities, while value-oriented segments have become more price-sensitive and selective.

This shift is reshaping how buyers and sellers should interpret market signals across the coast.

Why Mauna Lani and Mauna Kea Continue to Perform Well

What Buyers Are Responding To

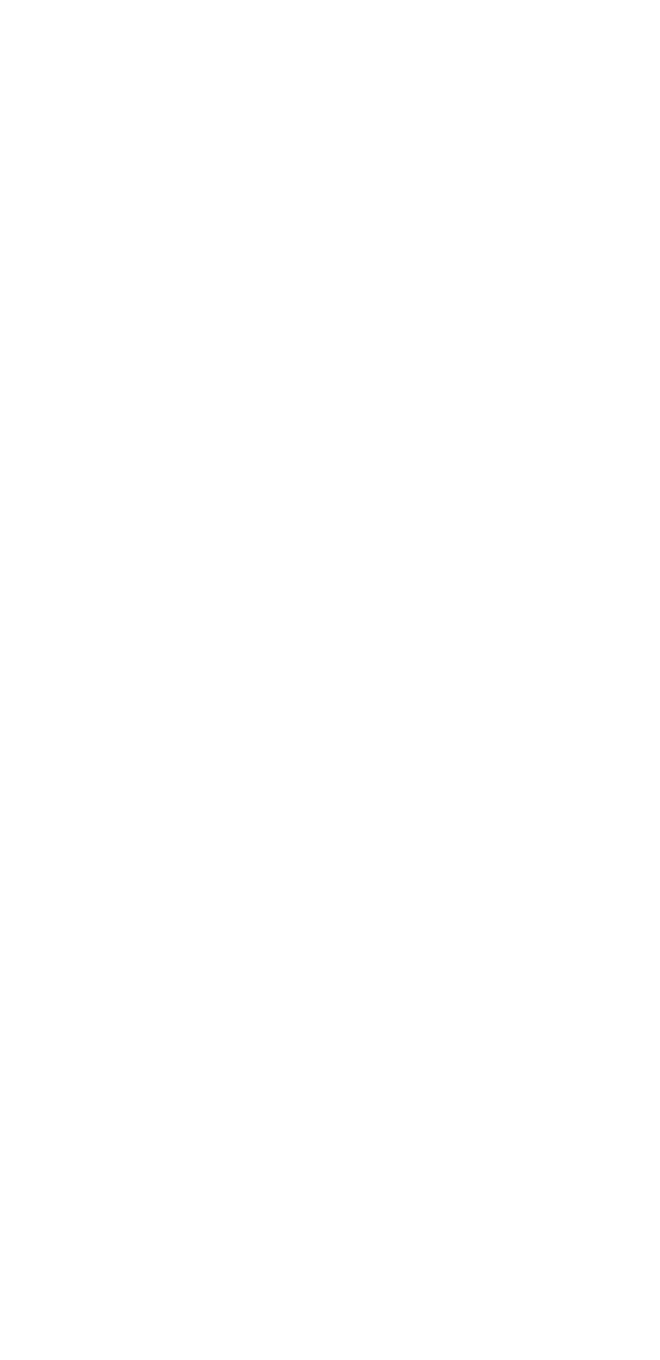

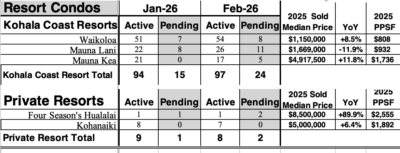

Mauna Lani Resort and Mauna Kea Resort have shown healthy activity in the last 30 days. These communities benefit from long-established resort infrastructure, golf courses, beaches, and brand recognition built over decades.

Buyers are gravitating toward environments that feel complete and proven, particularly when making long-term ownership decisions.

Market Behavior at the Premier Resort Level

Well-positioned properties in these resorts are moving with greater consistency. This reflects renewed confidence in upper-tier resort living rather than speculative demand.

In Kohala Coast resort markets, confidence tends to favor familiarity, stability, and depth of lifestyle.

Why Waikoloa Resort Activity Remains More Measured

Inventory and Value Sensitivity

Waikoloa Resort remains an important entry point into Kohala Coast resort ownership. However, higher inventory levels and increased pricing sensitivity are contributing to a slower pace of activity.

Buyers are there, but more selective. Value and positioning matter more here than at the premier resort level.

What This Means for Buyers and Sellers

This segment is more competitive and requires realistic expectations. Pricing discipline and understanding buyer priorities are essential to moving transactions forward.

Waikoloa continues to serve a distinct role, but its performance differs from Mauna Lani and Mauna Kea.

Private Kohala Coast Resorts: Scarcity Drives Demand

How Private Clubs Behave Differently

Private resort communities, Kukio, Hualalai, and Kohanaiki, operate under different dynamics. Inventory is extremely limited, and buyers are typically less influenced by short-term market cycles.

Decisions at this level are driven primarily by lifestyle alignment, privacy, and long-term enjoyment.

Recent Activity at the Top of the Market

This dynamic was highlighted by a $38 million sale at Kukio this month, setting a new record and surpassing the previous $37 million benchmark set by KE TEAM.

We have two in properties in Kukio and one Hualalai property in escrow, reinforcing continued depth of demand for exceptional private resort properties.

What Buyers Often Misunderstand About Kohala Coast Markets

A common misconception is that the Kohala Coast moves as a single market. In reality, each resort community responds differently due to its unique nature.

Lifestyle fit, scarcity, and amenity depth now outweigh general market trends, especially at the upper end.

Understanding where momentum exists—and why—is essential for informed decision-making.

Market Takeaway: A Segmented, Lifestyle-Driven Coast

The Kohala Coast is increasingly defined by segmentation rather than averages.

Premier resorts are outperforming due to established lifestyle ecosystems. Private clubs remain insulated by scarcity. Value-oriented resort segments require more careful positioning.

For buyers and sellers alike, recognizing these distinctions is critical in today’s environment.

www.KETeamHawaii.com

Frequently Asked Questions

What is driving demand on the Kohala Coast right now?

Demand is being led by lifestyle-focused buyers prioritizing established resorts and private communities over entry-level options.

Why are Mauna Lani and Mauna Kea more active than other resorts?

Their long-term amenity depth, walkability, and proven resort environments attract buyers seeking stability and usability.

Is Waikoloa Resort still a viable option?

Yes, but it is more price-sensitive. Buyers are selective, and inventory levels play a larger role in transaction timing.

Why do private resorts behave differently from other markets?

Private clubs have extreme inventory scarcity, and buyers focus on long-term enjoyment rather than market timing.

Are ultra-luxury buyers affected by broader market cycles?

Less so. At this level, lifestyle alignment and exclusivity often outweigh economic fluctuations.

Does one Kohala Coast trend apply to all resorts?

No. Each resort functions as its own micro-market with distinct drivers and constraints.

Are record sales a sign of a broader market surge?

Not necessarily. They reflect demand concentration at the top rather than across all price segments.