Kai Ioh | Jan 2026

Big Island Resort Market Overview

The Big Island resort real estate market in 2025 did not move in a single direction. Instead, it diverged by resort type, inventory levels, and buyer profile. While some Kohala Coast resorts experienced oversupply and slower absorption, private resorts remained constrained by limited inventory and lifestyle-driven demand.

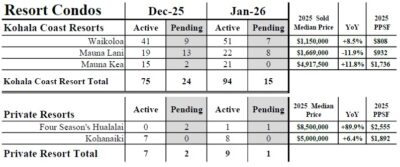

Kohala Coast Resort Condo Market

Jan 2026 Big Island Resort market data

Overall, the Kohala Coast resort condo market reflected approximately 10 months of supply based on current inventory and the prior year’s sales pace. However, Waikoloa, Mauna Lani, and Mauna Kea function as distinct micro-markets, each with unique pricing behavior and absorption patterns.

Waikoloa Resort

Waikoloa Beach Resort 2025 Market Recap

Waikoloa showed clear oversupply conditions in 2025. Condo sales declined year-over-year, inventory expanded, and price per square foot declined even as median prices remained elevated. Absorption exceeded 16 months using the 2025 sales pace, giving buyers more choice and extending selling timelines.

Mauna Lani Resort

Mauna Lani remained the most balanced Kohala Coast resort market. Despite pricing adjustments, demand exceeded the prior year and months of supply measured approximately 4.7 months, reflecting healthier absorption relative to inventory.

Mauna Kea Resort

2025 Mauna Kea Resort Market Recap

Mauna Kea continued to function as a boutique market. With limited entry-level inventory and a smaller overall footprint, pricing increased even as months of supply appeared elevated. Only a small number of transactions occurred, reinforcing its niche status.

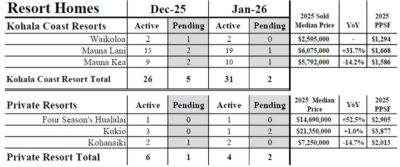

Kohala Coast Resort Single-Family Homes

Resort single-family homes experienced slower absorption than condos. With 31 homes currently available, it would take an estimated 22 months to clear inventory at the current pace, highlighting oversupply in higher price segments.

Jan 2026 Big Island Resort Home market update

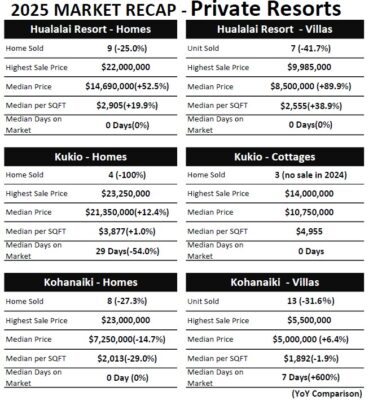

Private Resort Markets

Big Island Ultra Luxury Market Recap 2025

Private resorts such as Hualalai and Kukio remained undersupplied in 2025. Sales declined due to limited inventory rather than weakening demand, with many transactions occurring off-market. Median prices and price per square foot exceeded prior-year levels.

Kohanaiki remained an exception. With significant development still underway, pricing softened as ongoing construction reduced urgency among ultra-luxury buyers.

Frequently Asked Questions

Is the Big Island resort market slowing?

The market is moderating rather than slowing uniformly. Oversupply affected some resorts, while others remained constrained by limited inventory.

Are all Kohala Coast resorts experiencing the same conditions?

No. Waikoloa, Mauna Lani, and Mauna Kea each operate as distinct micro-markets with different absorption rates and pricing dynamics.

Why did private resorts outperform broader resort markets?

Private resorts are driven by lifestyle demand and scarcity. Limited inventory supported pricing even as overall transaction volume declined.

What matters most for buyers and sellers moving forward?

Resort-specific inventory levels, pricing accuracy, and understanding absorption rates are more important than headline market trends.

Kohanaiki Golf Course with JPGA Tour Pro Koshiro Maeda